I don’t generally gush over DeKalb’s choices of consultants, but I believe EPI was worth every penny – both times – because of their plain talk about our financial situation and the state of city operations.

Too bad DeKalb didn’t take some important advice.

One of the harsh realities was and is the OPEB, which stands for Other Post-Employment Benefits. OPEB is a defined-benefit, comprehensive health insurance plan for City of DeKalb retirees who participate in a pension plan (i.e., full-timers who meet years-of-service requirements). Compared with the pension plans, OPEB is not very highly regulated. There’s no trust fund established, and since the city doesn’t have to pay more than a required annual contribution, it doesn’t. There are no reserves for the future.

This was the picture when EPI came on the scene in 2009:

• Depending on the retirement age of the labor contract/pay plan that applied, some city workers qualified for benefits as early as age 50.

• Employees did not contribute to the OPEB until retirement.

• OPEB covered the retiree for life.

• Some plans had spousal and/or dependent benefits.

• The city at that time was paying approximately 87% of the premium for each retiree.

• DeKalb’s contribution as sole employer of the plan came to about $1 million per year.

• The unfunded liability reported for fiscal 2008 was $29.4 million, which was more than the liability for any city pension fund at the time.

Aided in part by new federal reporting requirements that kicked in the same year of its analysis of the plan, EPI determined that the above liability was probably understated, due to medical inflation running much higher than core inflation and likely inadequately accounted for in setting premiums. “Under this scenario,” the 2009 EPI report said, “even if the City fully funded the liability as required, the costs would continue to outpace contributions to infinity.”

DeKalb later that year reported an unfunded liability of $40.4 million in its annual financial report for fiscal 2009.

EPI recommended termination of the OPEB plan as soon as possible, but DeKalb decided to keep it. The city re-negotiated labor contracts and pay plans as they expired into tiered programs that increased retiree contributions and reduced benefits based on hire dates and longevity. New hires from 2011 onward, for example, do not participate in the OPEB, but have defined-contribution plans (PEHPs) with a city match.

The consultants congratulated the city for having made substantial progress when they returned for follow up in 2013. The unfunded liability was down to $20.8 million. However, they disagreed with the city’s retaining the OPEB for retirees at all, saying, “This excess strain on DeKalb’s budget will be evident for many years to come.” They still recommended a complete phase-out.

Why the continued budget strain? It’s partly because the way OPEB works has really barely changed. The city muddles along with its pay-as-you-go funding policy, retirees don’t contribute anything until retirement, the city contributes 80% of the premiums for many, and some plans still cover retired employees for life, even after Medicare kicks in.

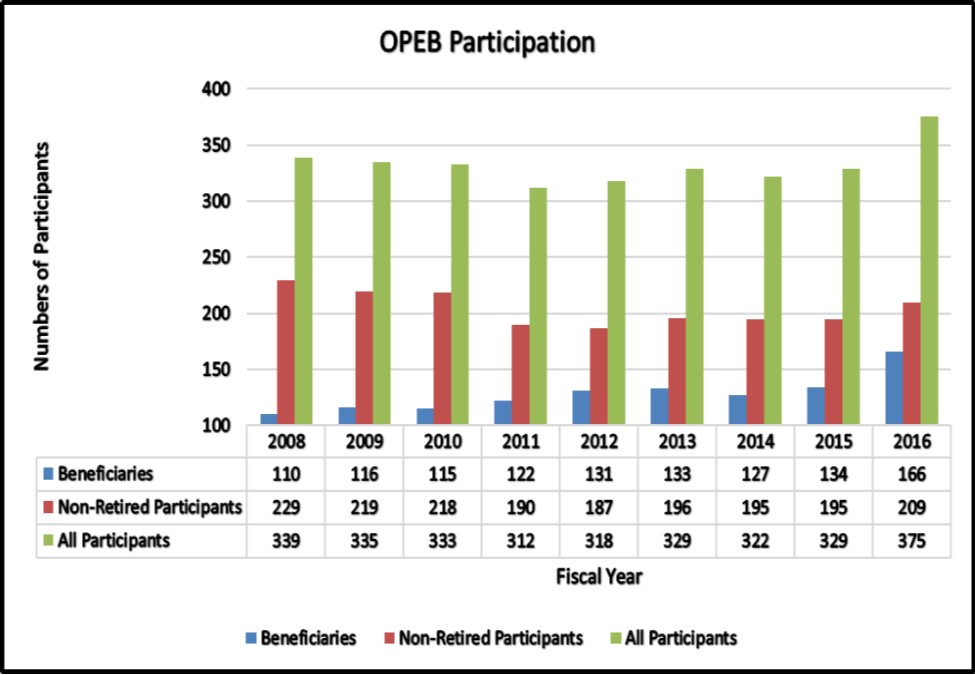

Another large factor is a current acceleration in annual growth of beneficiaries. There are simply much greater numbers of DeKalb workers retiring, or preparing to retire. In 2011, I identified 62 city workers covered by the IMRF pension plan aged 45 and older, who were therefore within 10 years’ striking distance of the minimum age for retirement as expensive Tier One employees. They are making their moves now. In fiscal 2015, the city reported 140 beneficiaries of IMRF pension benefits, in 2016 it was 144, and in the latest annual financial report, for the 6-month “fiscal year” called 2016.5, it was 158.

Meanwhile, the police and fire pension plans added 12 beneficiaries to their pension plan over the same period, for a citywide total of 30 beneficiaries added in 2-1/2 years.

Because of the large (and possibly unprecedented) number of expensive retirements combined with continuing medical inflation, I expect the city’s required contributions and the unfunded liability to continue to grow rapidly. The latest numbers available, for fiscal 2016, show the unfunded liability had crept back up to $23.9 million already – and that’s a figure from 1-1/2 years ago.

It’s the pension liabilities that have captured attention for the past several years, but the other post-employment benefit, the OPEB, deserves some of that spotlight, too.